Small business accounting software with inventory management is a powerful tool that can help small businesses streamline their operations, save time, and make better decisions. This software can help businesses track their income and expenses, manage their inventory, and generate reports that can help them understand their financial performance.

There are many different types of small business accounting software with inventory management capabilities available, so it is important to choose the one that is right for your business. Some of the key features to consider when choosing software include ease of use, scalability, integration capabilities, and customer support.

Overview of Small Business Accounting Software with Inventory Management

Small business accounting software with inventory management is a comprehensive solution designed to streamline financial operations and enhance inventory control for small businesses. It provides a centralized platform to manage all aspects of accounting, including invoicing, expense tracking, inventory management, and reporting.

Key features of small business accounting software with inventory management include:

- Invoicing: Create and send professional invoices with ease, track payments, and manage customer accounts.

- Expense tracking: Record and categorize expenses, attach receipts, and generate expense reports for tax purposes.

- Inventory management: Track inventory levels, set reorder points, and manage multiple warehouses or locations.

- Reporting: Generate financial reports such as profit and loss statements, balance sheets, and cash flow statements.

Types of Small Business Accounting Software with Inventory Management

Small business accounting software with inventory management capabilities comes in various types, each with its own advantages and disadvantages. Understanding the different types can help businesses choose the best solution for their specific needs.

The main types of small business accounting software with inventory management include:

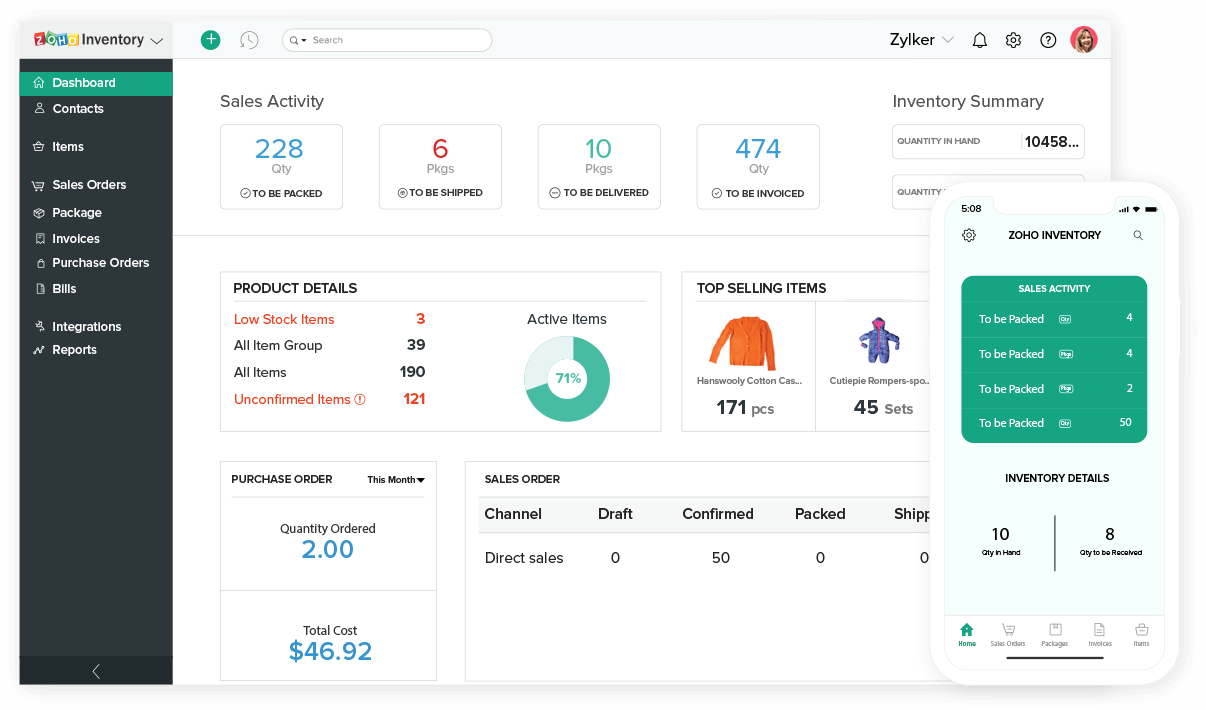

Cloud-based Software

- Strengths: Accessible from anywhere with an internet connection, automatic updates, scalability, cost-effective.

- Weaknesses: Requires internet connectivity, may have limited customization options, potential security concerns.

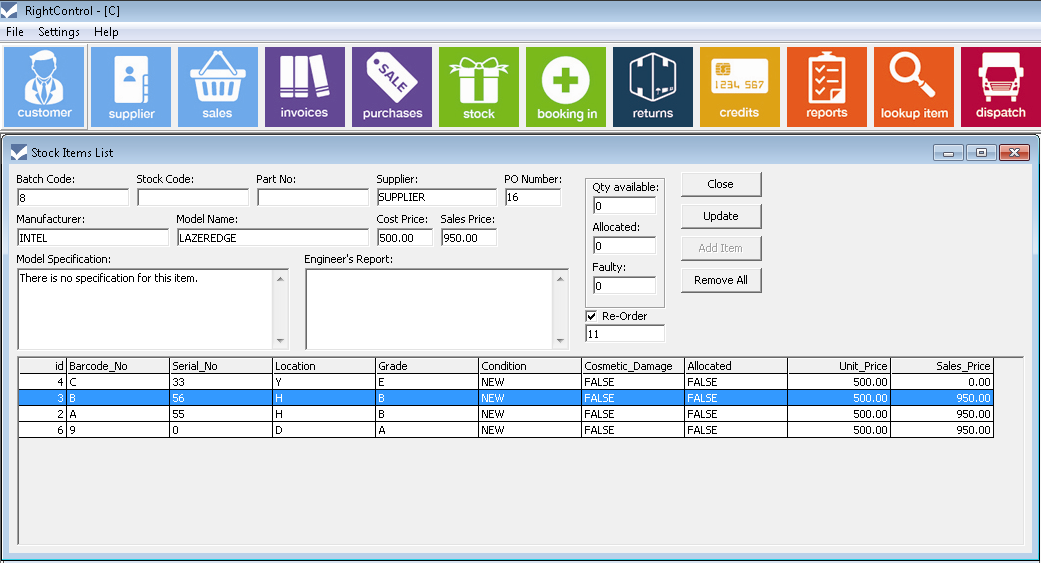

Desktop-based Software

- Strengths: Installed on a local computer, provides greater control and customization, no internet connection required.

- Weaknesses: Not accessible remotely, requires manual updates, can be more expensive than cloud-based solutions.

Mobile-based Software

- Strengths: Convenient for on-the-go access, allows for real-time inventory tracking, suitable for businesses with mobile workforces.

- Weaknesses: May have limited functionality compared to desktop or cloud-based software, can be more prone to data loss.

Key Features to Consider When Choosing Small Business Accounting Software with Inventory Management

Selecting the right accounting software with inventory management capabilities is crucial for small businesses. Consider these essential features to ensure you choose the best fit for your business needs:

Ease of Use

Choose software that is user-friendly and intuitive, especially if you don’t have a dedicated accounting team. Look for a clear and organized interface, customizable dashboards, and helpful tutorials.

Scalability

As your business grows, your accounting needs will evolve. Choose software that can scale with your operations, accommodating increasing transaction volumes and expanding inventory levels.

Integration Capabilities

Integrate your accounting software with other business applications, such as CRM, e-commerce platforms, and payment gateways. This seamless integration streamlines processes and eliminates manual data entry.

Customer Support

Reliable customer support is essential for any software implementation. Look for vendors that offer timely and responsive support via multiple channels, including phone, email, and live chat.

Implementation and Integration of Small Business Accounting Software with Inventory Management

Implementing and integrating small business accounting software with inventory management is crucial for streamlined business operations and accurate financial reporting. This guide provides a step-by-step process to ensure a successful implementation and integration.

Data Migration

Data migration involves transferring existing inventory and accounting data from your old system to the new software. Ensure that all essential data, such as inventory items, transaction history, and customer information, is accurately transferred.

User Training

Thoroughly train your team on the new software’s functionality. Provide hands-on training sessions, user manuals, and online resources to ensure they are proficient in using the system.

Ongoing Maintenance

Regularly update the software with the latest releases to benefit from new features and bug fixes. Additionally, establish a system for ongoing maintenance, including data backups, system monitoring, and user support.

Best Practices for Using Small Business Accounting Software with Inventory Management

Leveraging small business accounting software with inventory management effectively requires adherence to best practices. These practices ensure accurate inventory tracking, efficient cost accounting, and comprehensive financial reporting.

Below are some of the key best practices to consider:

Inventory Tracking, Small business accounting software with inventory management

- Establish a comprehensive inventory tracking system that includes regular stock-taking and cycle counting.

- Utilize barcodes or RFID tags to automate inventory tracking and minimize errors.

- Implement a perpetual inventory system to provide real-time inventory visibility.

- Regularly reconcile inventory records with physical counts to ensure accuracy.

- Set up alerts for low stock levels to prevent stockouts.

Cost Accounting

- Select an accounting method (e.g., FIFO, LIFO, weighted average) and consistently apply it.

- Track inventory costs, including purchase price, freight, and handling charges.

- Allocate overhead costs to inventory based on appropriate allocation methods.

- Regularly review cost of goods sold (COGS) reports to identify variances and optimize pricing.

- Utilize the software’s reporting capabilities to generate detailed cost accounting reports.

Financial Reporting

- Ensure that the software generates financial statements (e.g., balance sheet, income statement) that comply with applicable accounting standards.

- Use the software’s reporting tools to create customized reports for specific stakeholders (e.g., management, investors, lenders).

- Regularly review financial reports to identify trends, analyze performance, and make informed decisions.

- Utilize the software’s budgeting and forecasting capabilities to plan and manage financial resources.

- Implement internal controls to ensure the accuracy and reliability of financial reporting.

Case Studies and Success Stories of Small Businesses Using Accounting Software with Inventory Management

Small businesses that have implemented accounting software with inventory management have experienced significant benefits, including improved accuracy, efficiency, and profitability. Here are a few case studies and success stories:

Online Retailer Improves Inventory Management

An online retailer struggled with inventory management, often resulting in overstocking or stockouts. By implementing accounting software with inventory management, the retailer gained real-time visibility into inventory levels, automated inventory replenishment, and improved order fulfillment accuracy. As a result, the retailer reduced inventory carrying costs by 15% and increased sales by 10%.

Manufacturing Company Streamlines Operations

A small manufacturing company faced challenges in managing inventory across multiple warehouses and production lines. By implementing accounting software with inventory management, the company centralized inventory data, automated inventory tracking, and improved coordination between departments. This resulted in a 20% reduction in production lead times and a 15% increase in production output.

Emerging Trends in Small Business Accounting Software with Inventory Management

The landscape of small business accounting software with inventory management is constantly evolving, driven by technological advancements and changing business needs. Emerging trends are shaping the industry, offering new opportunities for businesses to streamline their operations and gain a competitive edge.

One of the most significant trends is the integration of artificial intelligence (AI) and machine learning (ML) into accounting software. AI-powered tools can automate repetitive tasks, such as data entry, invoice processing, and inventory tracking. This frees up valuable time for business owners and accountants to focus on strategic decision-making and growth initiatives.

Cloud-Based Accounting

Cloud-based accounting software is gaining popularity due to its accessibility, scalability, and cost-effectiveness. Businesses can access their accounting data from anywhere with an internet connection, eliminating the need for on-premises servers and IT maintenance. Cloud-based solutions also offer real-time data updates, allowing businesses to stay informed about their financial performance.

Mobile-Friendly Interfaces

With the increasing use of smartphones and tablets, accounting software is becoming more mobile-friendly. Businesses can now manage their finances on the go, track inventory levels, and generate reports from their mobile devices. This convenience empowers business owners to make informed decisions anytime, anywhere.

Data Analytics and Reporting

Advanced accounting software now offers robust data analytics and reporting capabilities. Businesses can analyze their financial data to identify trends, optimize inventory levels, and forecast future cash flow. These insights help businesses make data-driven decisions and stay ahead of the competition.

Integration with E-commerce Platforms

To streamline sales and inventory management, small businesses are integrating their accounting software with e-commerce platforms. This integration allows businesses to automatically track sales, update inventory levels, and process payments, eliminating manual data entry and reducing errors.

Cybersecurity Enhancements

As businesses rely more heavily on technology, cybersecurity has become a top priority. Accounting software providers are investing in robust security measures to protect sensitive financial data from cyber threats. Businesses can ensure the confidentiality and integrity of their financial information.

Final Review: Small Business Accounting Software With Inventory Management

Small business accounting software with inventory management can be a valuable asset for any small business. By choosing the right software and using it effectively, businesses can improve their financial performance and make better decisions.

FAQ Compilation

What are the benefits of using small business accounting software with inventory management?

Small business accounting software with inventory management can help businesses save time, improve accuracy, and make better decisions.

What are the key features to consider when choosing small business accounting software with inventory management?

Some of the key features to consider when choosing small business accounting software with inventory management include ease of use, scalability, integration capabilities, and customer support.

How can I implement small business accounting software with inventory management?

There are many different ways to implement small business accounting software with inventory management. The best approach will vary depending on the size and complexity of your business.